Amazon Delivery Service Partners Profit Margins and Other Details

Evaluating Profit Margins

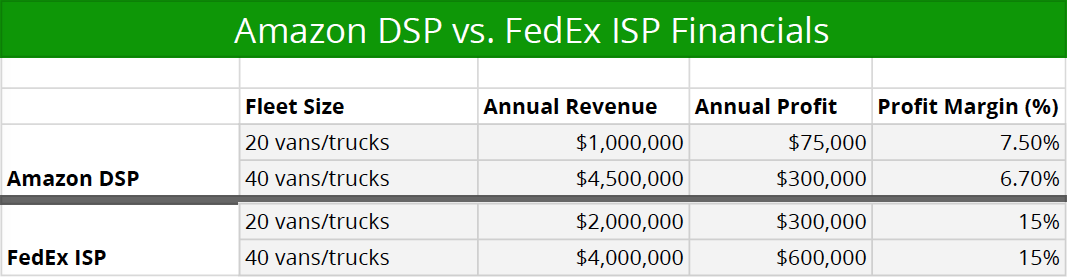

Amazon’s Delivery Services Partners website advertises an annual revenue potential of $1 million to $4.5 million. They also say that this revenue stream translates to an annual profit potential of $75,000 to $300,000.

The program is careful to note a few things: first, these estimates assume a fleet of 20-40 vans. Secondly, they admit they only estimate these numbers based on their internal research, “profit figures...are projections only and are not based on actual results of delivery companies. We do not guarantee results of any kind.”

In a FedEx Ground route business, we would expect a company with 20 vans or box trucks to generate annual revenue close to $2 million with an annual profit of $300,000.

Let’s break that down a bit more.

Amazon DSP financials via the Amazon Logistics website. FedEx financial estimates based on industry averages from our experiences as brokers.

We base these FedEx Ground financial estimates on industry averages where FedEx Ground Independent Service Providers earn approximately $100,000 in revenue per fleet van or box truck and healthy businesses have profit margins ranging from 10%-20%.

The important thing to remember is that while both networks can be profitable, FedEx Ground routes have a decades long history of financial stability and equity value. This does also mean, however, that FedEx Ground routes can be more expensive to get into due to the increased value.

Valuations for Amazon Routes

Let’s take a moment to talk about valuations for Amazon routes and how they differ from FedEx Ground routes.

There are two primary metrics used for valuing businesses in the logistics space: Percentage of Revenue and Multiple of Earnings.

Percentage of Revenue: This metric represents the purchase price as a percentage of the projected annual revenue of the business.

Amazon Logistics businesses typically sell at an average of 40% of annual revenue. This valuation can fluctuate from as low as 25% of annual revenue to as high as 55% of annual revenue.

By comparison, FedEx Ground contracting businesses typically sell within a range of 60% to 85% of annual revenue.

Multiple of Earnings: This metric represents the purchase price as a multiple of the EBITDA, or net operating income, of the business.

The EBITDA represents Earnings Before Taxes, Depreciation, or Amortization. Basically, this refers to your net operating income before you pay taxes, before you account for depreciation of assets, before you pay any debt, before you spend any CapEx on vehicles or equipment, and before you pay yourself. All of these expenses are unique to every business owner based on how your financials are structured and the decisions you make.

Amazon businesses typically sell between 2 and 3.5 times the annual net income of the business. FedEx Ground businesses typically sell closer to 4 and 5 times the annual net income of the business.

These discrepancies in value are largely due to the increased equity value and long-standing reliability of the FedEx Ground network. It is expected that as the Amazon Logistics network continues to grow and develop you could reasonably expect valuations to increase as well, but so too will the FedEx Ground network.

Want to Learn More?

To gain a deeper understanding of Amazon DSP routes and other logistics opportunities, enroll in our Amazon Routes 101 E-Course. This course provides essential knowledge to help you determine if investing in logistics routes aligns with your business goals.